Accounts Receivable Insights & Risk Management Dashboard

Pairs well with

Accounts Receivable Insights & Risk Management Dashboard

Accounts Receivable Insights & Risk Management Dashboard

-

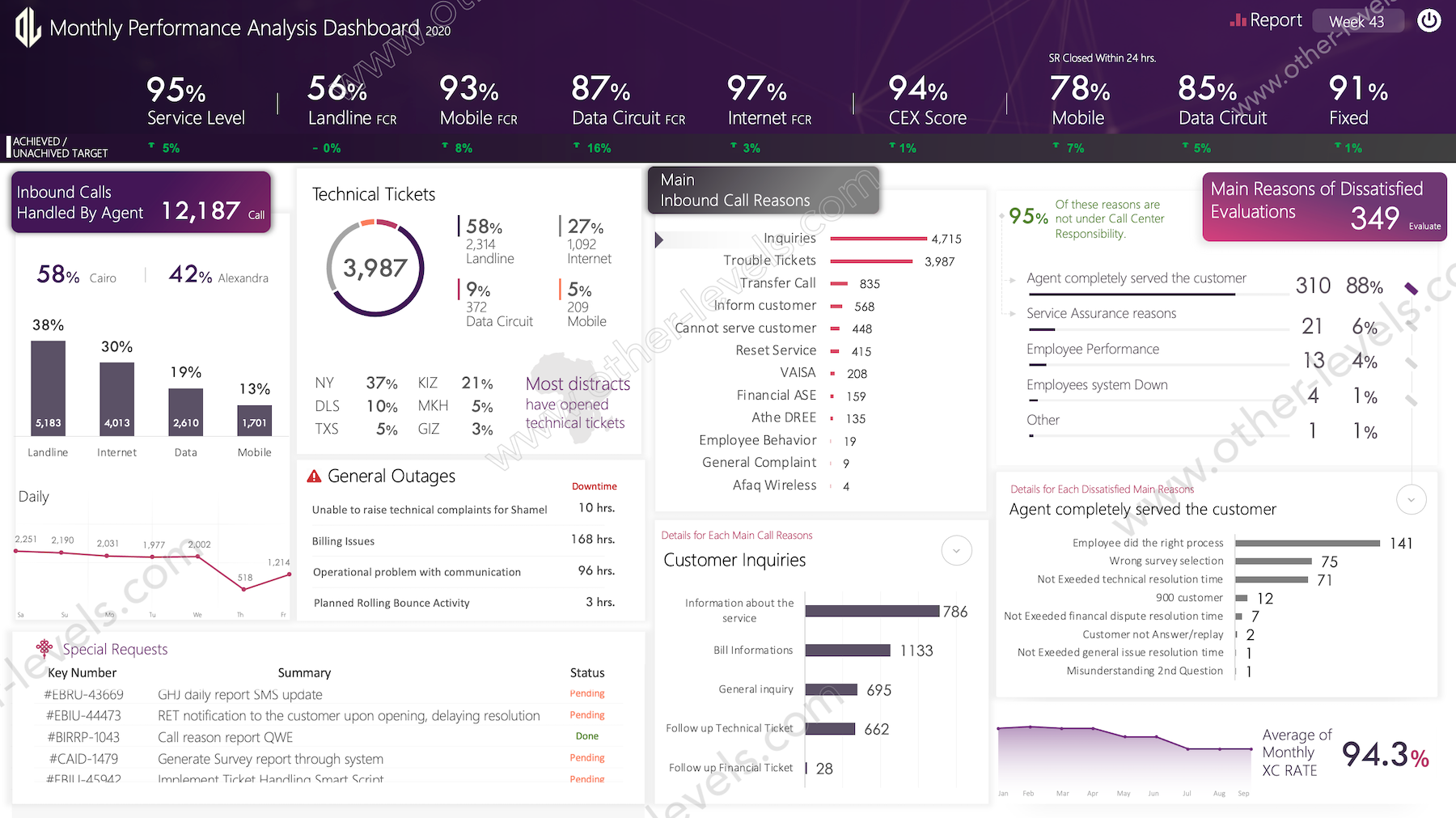

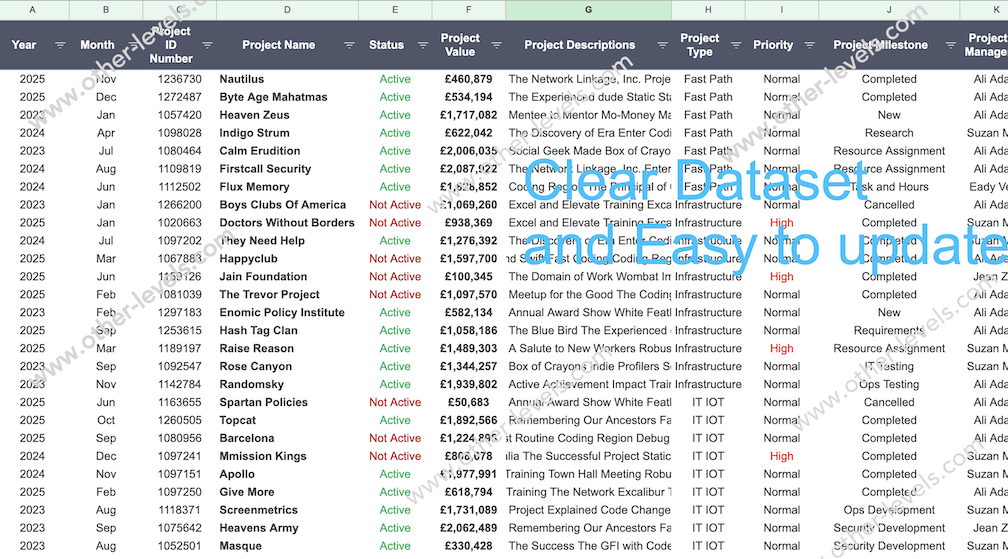

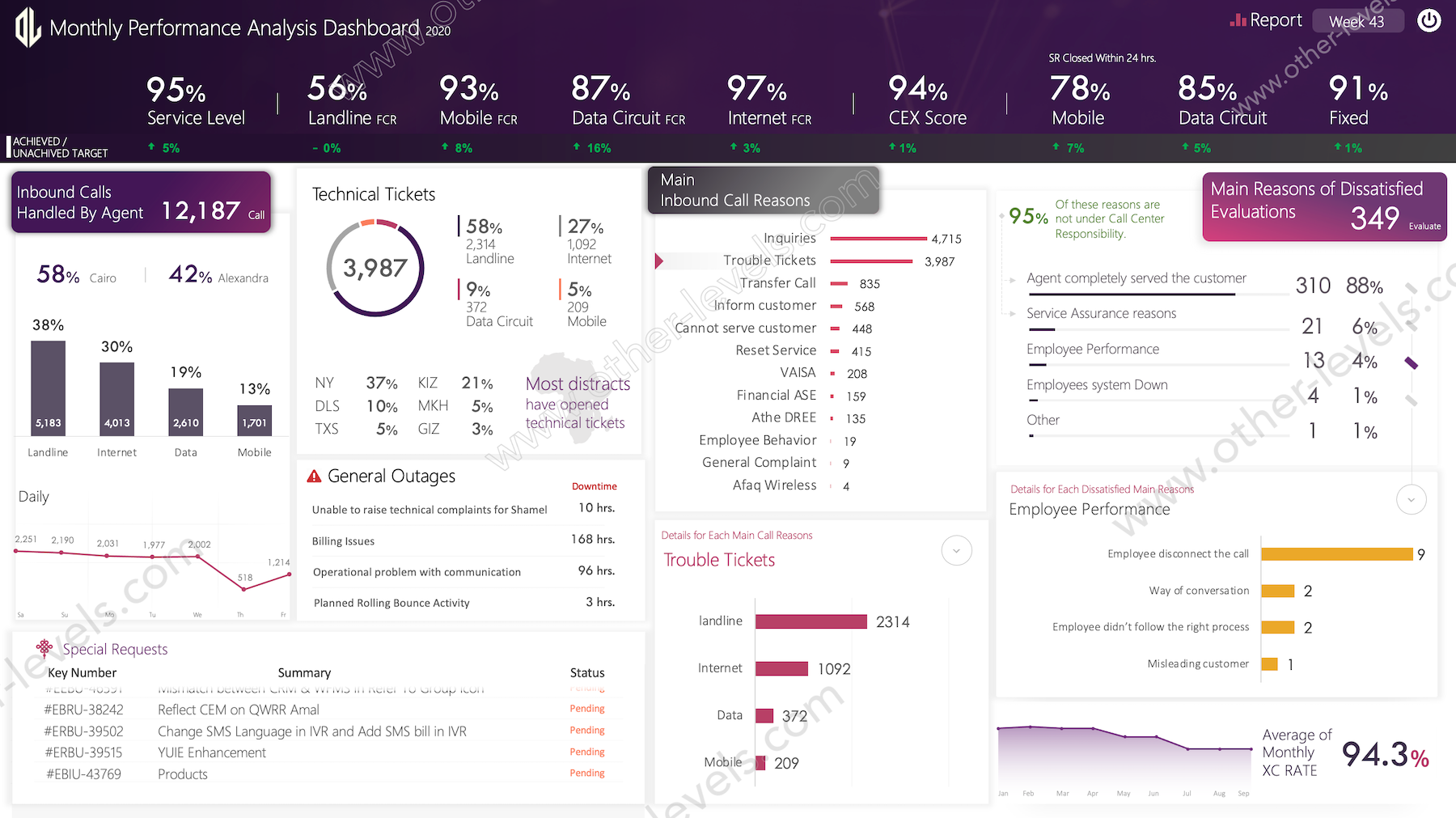

Customer Account Details:

- Unique Customer Account ID for easy identification.

- Customer Name, Branch/Location, and Group Category for effective segmentation.

2. Financial Metrics:

- Total Customer Balance and pre-approved Credit Limit.

- Available Credit Limit: Auto-calculated to show remaining credit capacity.

- Days Sales Outstanding (DSO): Tracks payment collection efficiency.

- Risk Status: Automatically assessed based on DSO and other key indicators.

3. Transaction Status:

- Current Amount, Overdue Amount, and Before Due Amount: All auto-calculated to reflect real-time transaction states.

4. Account Time Frame:

- Start Date and auto-calculated End Date to manage payment timelines.

5. Insights & Prioritization:

- Highlights Key Accounts that require attention due to overdue amounts or strategic importance.

Enhanced Functionality:

Visual Indicators: Conditional formatting highlights overdue amounts and risk levels.

Interactive Filters: Easily filter data by branch, risk status, or account group using slicers or dropdowns.

Summary Metrics: Display KPIs such as total overdue amounts, average DSO, and high-risk account percentages.

Trend Analysis: Visualize overdue amounts or DSO trends over time with charts or sparklines.

Actionable Insights Section: Provides recommendations for follow-up actions to mitigate risks or improve cash flow.

This Excel dashboard empowers businesses to effectively monitor receivables, assess credit health, and take proactive steps to minimize financial risks. It’s an indispensable tool for improving cash flow efficiency and gaining insights into account and credit management.

Template Features

Package Details

Software Compatibility

Skill Level Required

Beginner

FAQs

Please read our FAQs page to find out more.

Are the templates fully customizable?

Yes, all our templates are fully customizable. You can adjust the layout, data, and design elements to fit your specific needs. Our templates are designed to be flexible, allowing you to easily tailor them to your preferences.

Can I order a product in any language?

Yes, we provide products in any language. Simply select the "Other Language" option from the product options during your purchase. Once your order is placed, you will receive it within 48 hours.

What happens if I choose the wrong monitor screen size for my dashboard?

If you choose the wrong screen size, the dashboard may not display correctly on your monitor. Elements could appear too large, too small, or misaligned, affecting the readability and usability of the dashboard. We recommend selecting the appropriate screen size to ensure optimal viewing and performance.

Do I need any specific skills to use the dashboards?

Yes, to effectively use our advanced Excel dashboards, you must have at least a basic understanding of PivotTables. This will help you customize and analyze the data efficiently.

Do you provide services to add our own data to the purchased templates?

No, we do not offer services to input your specific data into the purchased templates. The templates are fully customizable, allowing you to easily add your own data.

Do I need specific skills to use the advanced Excel dashboard templates?

Our advanced Excel dashboards are easy to use, the only thing you need to know is how to work with PivotTables. With basic knowledge of PivotTables, you'll be able to customize and fully utilize these templates effortlessly. "Please check the skill level required"

Can I showcase these templates on websites or online platforms?

No, it is against our copyright policy to showcase these templates on websites, social media, or any online platforms. The templates are for your personal use only and are not permitted for public display or distribution.